Hi, Tom here. Thanks for joining - this is the final installment in Little Futures season 2. Hang tight for season 3. Last week: Cohort Futures. This week: Permeable Organizations.

The theory of the firm says firms exist to reduce coordination and transaction costs - all the things that make it hard for people to work together, solve problems, and deliver value effectively and efficiently.

But what happens when the tools for coordination are no longer confined to the insides of an organization?

It’s increasingly difficult to draw hard boundaries between the inside and the outside of an organization. And, for businesses that need to adapt, the biggest opportunities may come not from locking things down, but by opening them up. In a networked world, information, data and people flow through open channels between organizations.

We’re entering the age of Permeable organizations.

Scholars have begun to explore whether and how organizational boundaries may be more permeable than initially conceptualized, as firms are held to higher standards of accountability and must therefore open their boundaries to public scrutiny, operate more frequently as members of a broader network, and include a wider range of stakeholders in their planning processes and decisions.

The age of permeable organizations means: smaller firms, with orbital stakeholders using narrative strategy to negotiate with publics inside and out.

Let’s unpack that:

Smaller firms with orbital stakeholders

The information age enables small companies to have increasingly outsized impact and revenues - from a paper The Shrinking Hand: Why Information Technology Leads to Smaller Firms:

For most of its course, the 20th century has seen the triumph of the Chandlerian visible hand of the large corporation over the invisible hand of the market, and more generally the continuous rise of all hierarchical institutions, whether private firms or public bureaucracies. However, at the very time when Chandler (1977) celebrated the triumph of the giant firm and the managerial economy, new forces were actually reversing the previous trend, and hierarchies were fragmenting, replaced by smaller ones and more market transactions.

This trend should not be taken lightly - there is a cambrian explosion of software businesses:

However - small companies with outsized impact are only enabled by their environment and position within an ecosystem of fractured publics, markets and orbital stakeholders. Firms increasingly look less like factories and more like organisms - existing in an ecosystem of new kinds of stakeholders: partners, clients, social media, employees, influencers, users.

Instagram, while only a company of 13 when it sold to Facebook for a billion dollars, was already home to a whole economy of influencers, early adopters and passionate users. While there are few formal relationships here it’s clear that future companies will need stronger recognition of their orbital stakeholders - with new ways of giving them access, voice and ownership.

Narrative strategy to negotiate with fractured publics

This new world of permeable firms with fractured publics require a new kind of corporate comms and a new approach to strategy work. Strategy is no longer a moment in time internal activity - but rather an “always-on” negotiation with these fractured publics to coordinate strategic vision inside and outside the organization. (I’ve been calling this narrative strategy in my own work).

For larger organizations - this reframes “corporate comms” as something more essential - the public message increasingly becomes intertwined with the internal strategy. The keynote not only announces the product roadmap, but the product roadmap is shaped by the narrative the keynote can support.

For smaller firms and independents - it reframes blogging, working in public and weeknotes as acts of negotiation with a variety of fractured publics, from partners to clients to employees past and future.

One could say that we’re moving from a product-first environment to an ecosystem-first environment as per Bob Moore, CEO of Crossbeam:

Your place in an ecosystem of tech partners is just as important, if not moreso, than the quality of your product itself. Marc Andreesen was right when he quipped that “software is eating the world.” But in today’s marketplace, ecosystems are eating software.

Permeable Organizations and Pulsating Cells of Labor

Permeable organizations however, are disruptive - and it’s leaving some people behind. I believe the “natural” force here is for smaller companies of core staff working with expanding spheres of consultants, freelancers, influencers and gig workers “orbiting” the organization.

But traditional labor laws, unions and existing ideas about “jobs” and “work” are resisting the change, creating toxic environments for workers trying to navigate the gig economy.

In fact - technology is undermining our ability to protect workers. Franco Berardi calls this trend “fractals of time and pulsating cells of labor” and it destroys the ability for workers to organize. From after the future:

The organization of labor has been fragmented by the new technology, and workers’ solidarity has been broken at its roots. The labor market has been globalized, but the political organization of the workers has not. The info-sphere has dramatically changed and accelerated, and this is jeopardizing the very possibility of communication, empathy and solidarity.

In the new conditions of labor and communication lies our present inability to create a common ground of understanding and a common action. The movement that spread in the first years of the decade has been able to denounce the effects of capitalist globalization, but it has not been able to find the new path of social organization, and of autonomy from capitalist exploitation.

Venkatesh Rao explores this tension with a close look at AB5 and Prop-22 in California:

The gig economy is creating a genuinely new class of worker-consumer-citizen with genuinely new kinds of representational needs, calling for a genuinely new kind of politician. Unfortunately, though it is big and growing, it is still too small to be worth cultivating. If you have political ambitions, trying to genuinely represent gig workers who want to be gig workers is not a smart career move.

Unlike most valuable political constituencies, we are not legible, concentrated, and easy to target and activate for political purposes. We also do not have a sufficiently cohesive and predictable set of political attitudes or interests. Our interests cannot be summarized in a single, simple political message that a politician could ride to power.

But this will not always be the case, and I hope savvy young political aspirants see that.

The Community Economy

If the idea of “fractals of time and pulsating cells of labor” is a depressing view of the future, exit to community offers a glimmer of hope. The emerging exit to community movement creates pathways for organizations to create more aligned stakeholder relationships - not just with investors, but with communities, partners, users and more. It codifies the blurred boundaries of inside/outside into equitable structures. From the Exit to Community: a community primer

Exit to Community (E2C) is a strategy in the making. It's a different kind of story, one that connects the founders, workers, users, investors, activists, and friends who have been trying to feel their way toward a better kind of startup. Its endgame is to be a long-term asset for its community, co-owned and co-governed by those who give it life.

Big futures are forged through hard boundaries. Little futures emerge through osmosis.

This week’s links: the boundary of the firm

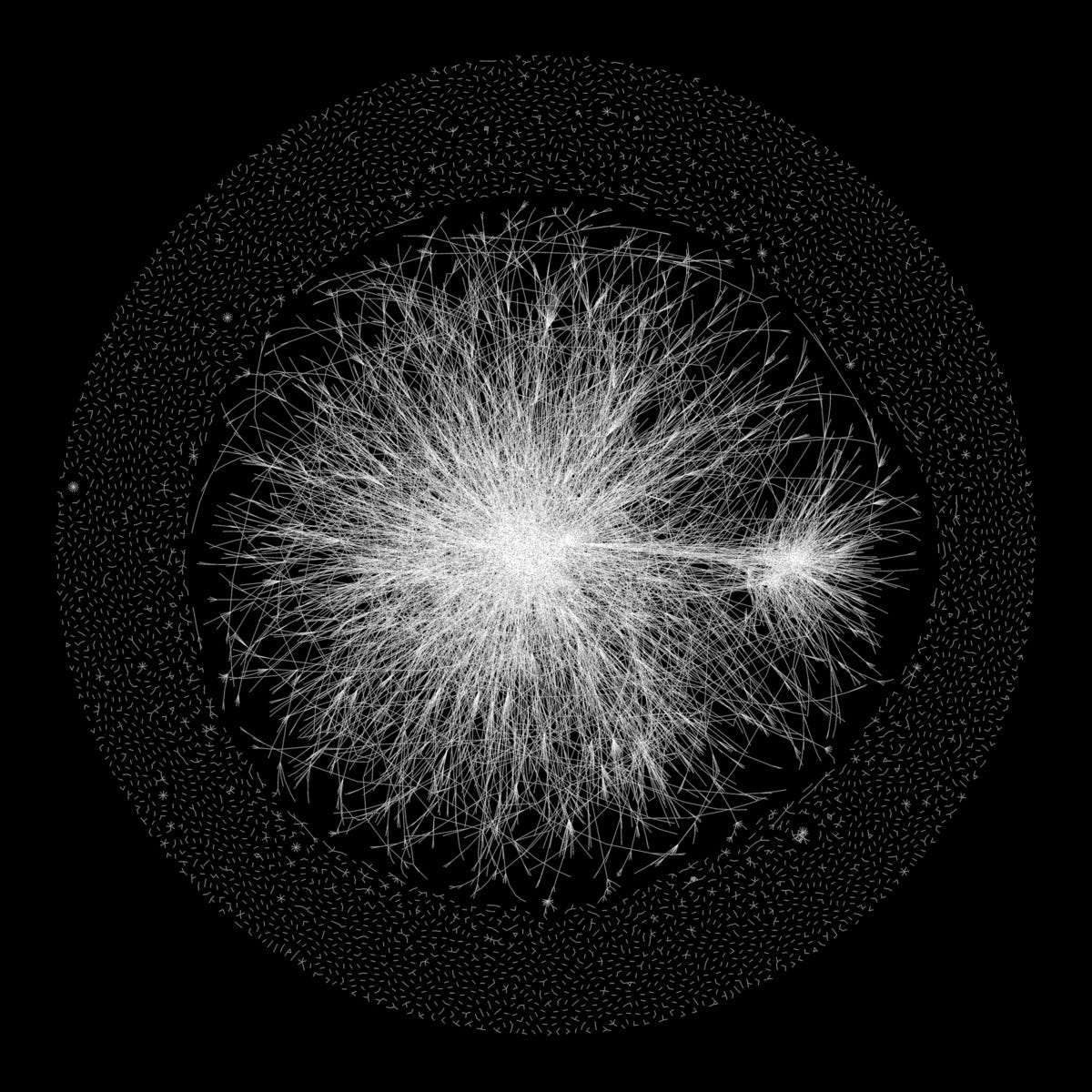

Visualizing Slack’s Shared Channels

I love this post visualizing slack shared channels - we’re watching organizations become more permeable!

Zooming in, we can see all kinds of interesting phenomena begin to emerge. The big branch of the mega-network jutting off to the right? That’s our Japanese users who share much more frequently in-country than North Americans or Europeans. The “wheels” around the outside, once sucked into the mega-network, become the arrowhead wedge shapes jutting out of the center. The number of connections between companies starts to grow even more quickly than the number of participants as customers begin finding new uses for shared channels.

The Mutualist Economy

Pair this with the exit to community idea - the mutualist economy:

This essay proposes a new model of personal and public wealth-building that can address the current crisis of inequality in the United States. [...] We then suggest a series of potential governmental policies that can help to ensure a more equitable wealth distribution in the future. Our proposed “mutualist” model of political economy would allow for the large-scale diffusion of productivity gains that may follow the installation of deployment of the next wave of general-purpose technologies.

Investing in tiny SaaS Companies

This thesis from Tiny Seed Fund examines the question of investing in small companies outside the VC hype-sphere.

We found 3158 publicly announced acquisitions, and over 93% of acquisitions did not get any mainstream technology press mentions and less than a third had taken traditional, multiple rounds of venture capital.

This very large number of Independent SaaS companies are assumed by most venture capital investors as being incapable of consistently providing the kinds of returns required by LPs, as they are not geared for hyper growth at all cost from the start.

We believe this assumption is incorrect.

And goes on:

This is something we have observed in our own portfolio already, and supports the thesis that investing as broadly as possible into Independent SaaS companies should increase a fund’s expected returns vs a more selective strategy.

Not investment advice I suppose?

Today’s art: Crimson by Mary Gartside - taken from her book An Essay on Light and Shade (1805) - (read more, full book)Before the Big Future, endless little futures.

Tom.